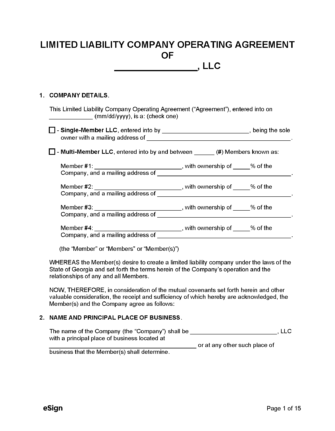

Georgia LLC Operating Agreement Template

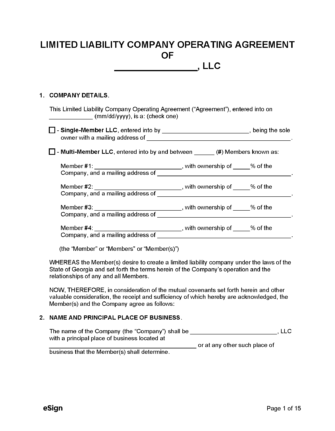

A Georgia LLC operating agreement is used to set forth the terms that determine how a limited liability company will be managed, structured, and regulated. The document addresses essential company details, such as who owns the business, whether the entity is a single-member or multi-member LLC, and where the principal place of business will be located. It also specifies how the LLC will vote in new members, distribute profits, and hold annual meetings.

Operating agreements are optional documents that needn’t be filed with the Georgia Secretary of State. Having said that, all limited liability companies are encouraged to draft an agreement to organize and structure the entity’s internal affairs.

Contents

Types (2)

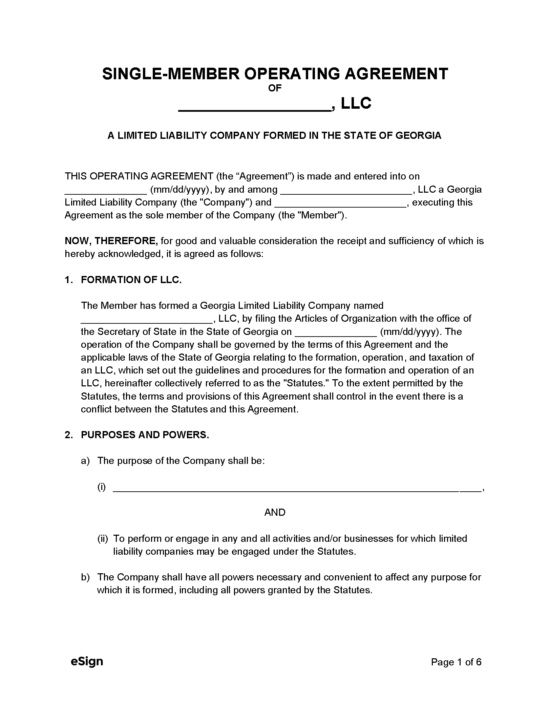

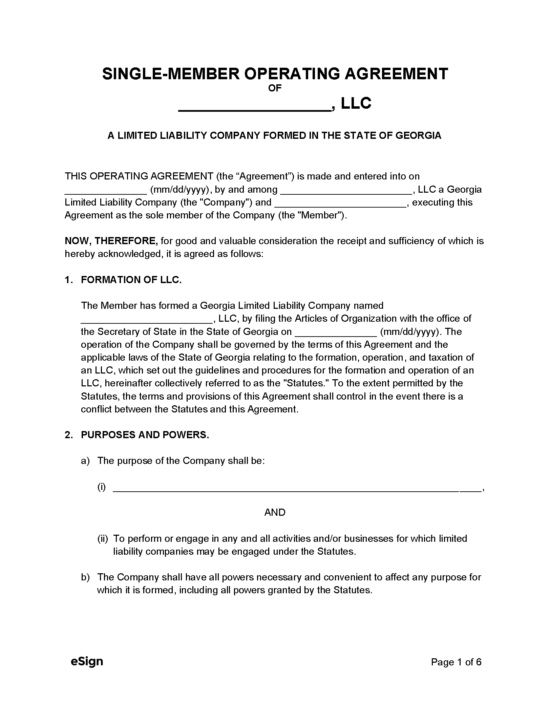

Single-Member LLC Operating Agreement – Designed for companies with only one (1) owner.

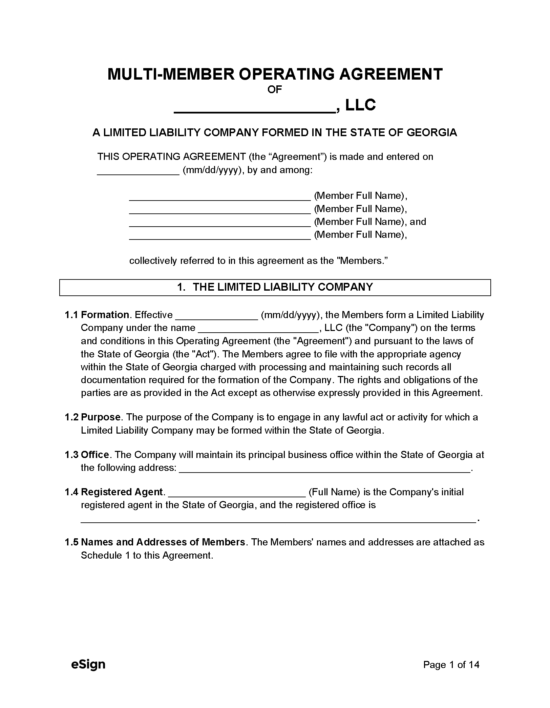

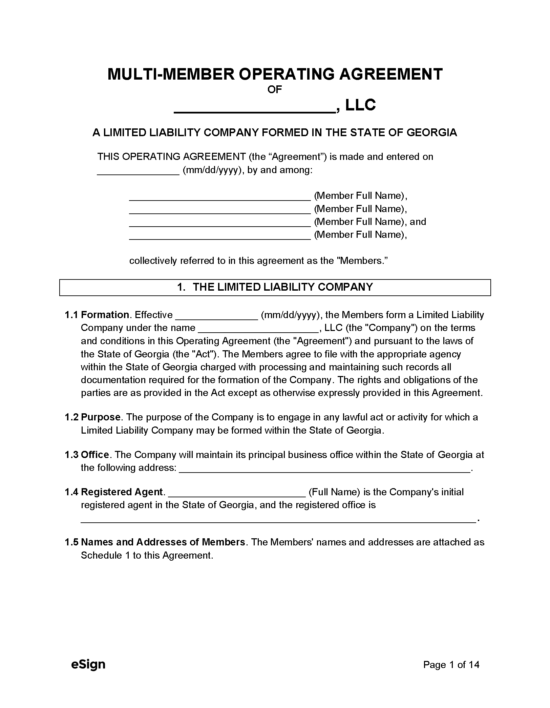

Multi-Member LLC Operating Agreement – An operating agreement that is suitable for LLCs with two (2) or more owners.

Laws

How to File (6 Steps)

- Step 1 – Choose an Entity Name

- Step 2 – Select a Registered Agent

- Step 3 – File with the Corporations Division

- Step 4 – Draft an LLC Operating Agreement

- Step 5 – Request an EIN

- Step 6 – Annual Registration

Step 1 – Choose an Entity Name

Business filers will start the entity formation process by choosing a company name. An LLC’s name needs to be distinguishable from other active business entities, and it must comply with Georgia’s name availability standards.

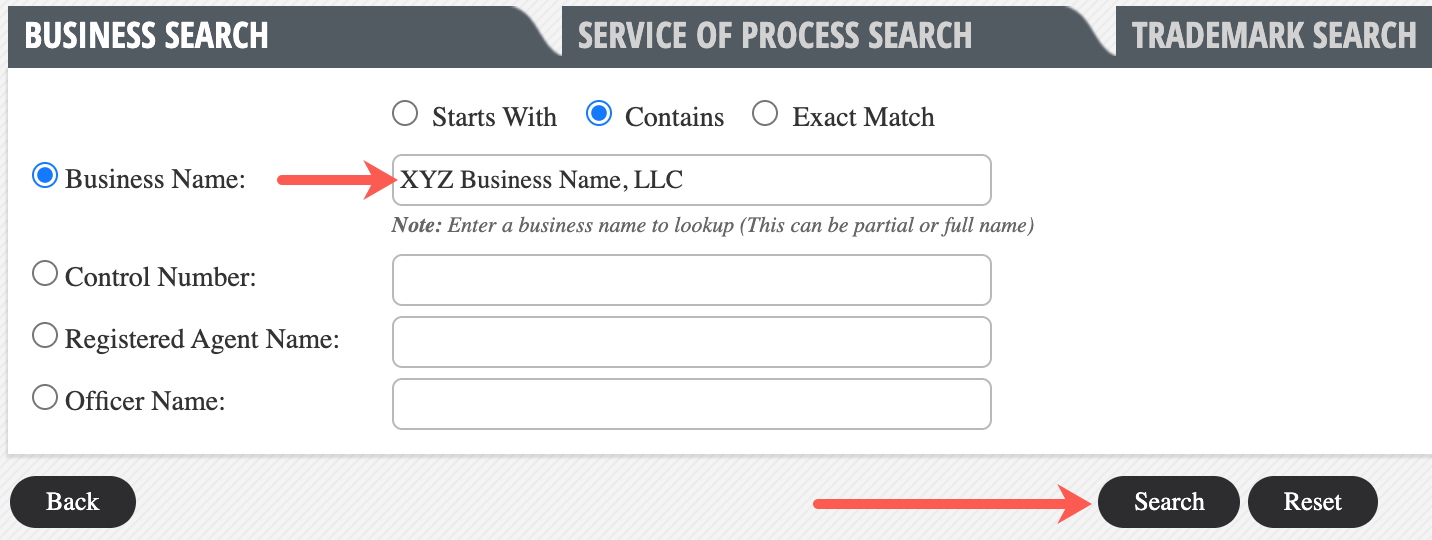

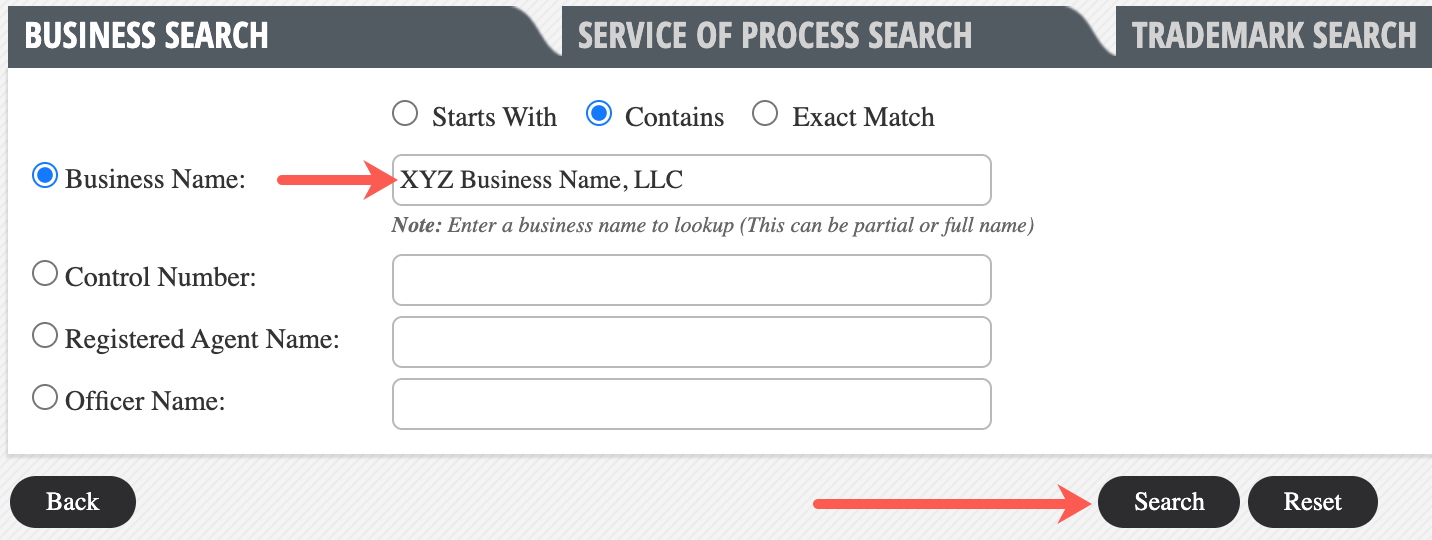

Perform a preliminary business search to determine whether the intended name has already been taken.

Name Reservation

While preparing the entity’s registration paperwork, business filers may wish to reserve the business name to guarantee its availability upon filing. Name reservations can be made online, in person, or by mail. After the request has been processed, the name will be reserved for thirty (30) days.

- Reserve Online

- Create an online account.

- Log in to the online filing service.

- Select name reservation.

- Fill out the request form.

- Pay the $25 fee with a credit card.

- Reserve by Mail or In Person

- Fill out a Name Reservation Request.

- Attach a $35 check or money order made payable to the “Georgia Secretary of State.”

- Mail or hand-deliver the Name Reservation Request and filing fee to the following address: Office of Secretary of State, Corporations Division, Name Reservation Request, 2 Martin Luther King Jr. Dr. SE, Suite 313 West Tower, Atlanta, Georgia 30334.

Step 2 – Select a Registered Agent

A registered agent is an individual or entity designated by the LLC to accept service of process, notices, and other paperwork on the company’s behalf. The registered agent must maintain a physical address in Georgia (P.O. boxes cannot be used).

The registered agent may be any of the following:

- An individual resident of Georgia;

- A domestic corporation or LLC; or

- A foreign corporation or LLC with the authority to conduct business in Georgia.

Note: A member, manager, or any other individual in the company can serve as the registered agent. However, the LLC cannot be its own registered agent.

Step 3 – File with the Corporations Division

Prior to filing, it is important to determine whether the LLC is a domestic or foreign entity. If the LLC is a new business being formed in Georgia, it is a domestic LLC. If the business has already been formed outside of Georgia, it is a foreign LLC.

Form a Domestic LLC

- File Online

- Create an online business filing account.

- Using the newly-created account, log in to the online filing service.

- Click on create or register a business.

- Supply the requested information regarding the business entity.

- Use a credit card to pay the $100 filing fee.

- File by Mail or In Person

- Complete the Articles of Organization.

- Fill out a Transmittal Information Form and attach it to the Articles of Organization.

- Draft a check or money order for $110 (payable to the “Georgia Secretary of State”).

- Mail or hand-deliver the Articles of Organization, Transmittal Information Form, and filing fee to the following address: Corporations Division, 2 Martin Luther King Jr. Dr. SE, Suite 313 West Tower, Atlanta, Georgia 30334.

Register a Foreign LLC

- File Online

- Create a user account for the Secretary of State’s online filing service.

- Log in to the online filing service using the newly-created account.

- Select create or register a business.

- Provide the necessary business information

- Pay the $225 filing fee with a credit card.

- File by Mail or In Person

- Fill out the Application for Certificate of Authority for Foreign LLC.

- Attach the $235 filing fee (payable by check or money order made out to the “Georgia Secretary of State”).

- Mail or hand-deliver both items to the following address: Corporations Division, 2 Martin Luther King Jr. Dr. SE, Suite 313 West Tower, Atlanta, Georgia 30334.

Note on Expedited Filing:

Processing times can be expedited for an additional fee. The Corporations Division offers the following filing services:

- Two (2) business days filing – $100

- Same day filing – $250

- One (1) hour filing – $1,000

Review the fee schedule to learn more about the expedited filing services offered by the Corporations Division.

Step 4 – Draft an LLC Operating Agreement

Although an operating agreement is not legally required to form a limited liability company in Georgia, it is highly recommended. An operating agreement is an essential tool that outlines the entity’s business policies and identifies the owners and managers.

- Single-Member Operating Agreement

- Multi-Member Operating Agreement

Step 5 – Request an EIN

After forming an LLC, business owners should contact the Internal Revenue Service (IRS) to see if the newly-created entity is required to obtain an Employer Identification Number (call 1-866-816-2065 or visit the IRS webpage). An Employer Identification Number, or EIN, is necessary for entities that will hire employees, pay an excise tax, or apply for bank loans or business licenses. It is also required if the LLC has multiple members.

- Request an EIN online – Access the application by selecting Apply Online Now.

- Request an EIN through the mail or by fax using Form SS-4 – See filing instructions.

Step 6 – Annual Registration

Limited liability companies will need to file an annual registration to inform the Secretary of State of any notable changes in the company. The first filing must occur between January 1st and April 1st of the year following the first year of formation in Georgia.

Annual registrations are filed online and require a $50 non-refundable filing fee.

Resources

Costs:

- Domestic filing fee: $100 online; $110 by mail & in person

- Foreign filing fee: $225 online; $235 by mail & in person

- Expedited filing fee: $100 to $1,000

- Name reservation: $25 online; $35 by mail & in person

- Annual registration fee: $50

Forms:

- Application for Certificate of Authority for Foreign LLC (PDF)

- Articles of Organization (PDF)

- Name Reservation Request (PDF)

- Transmittal Information Form – Georgia LLC (PDF)

Links:

- Where to file: Secretary of State – Corporations Division

- File online: Online Filing Service

- Entity search: Business Search

- Entity name information: Name Availability Standards

- Obtain business licenses: Georgia Department of Economic Development